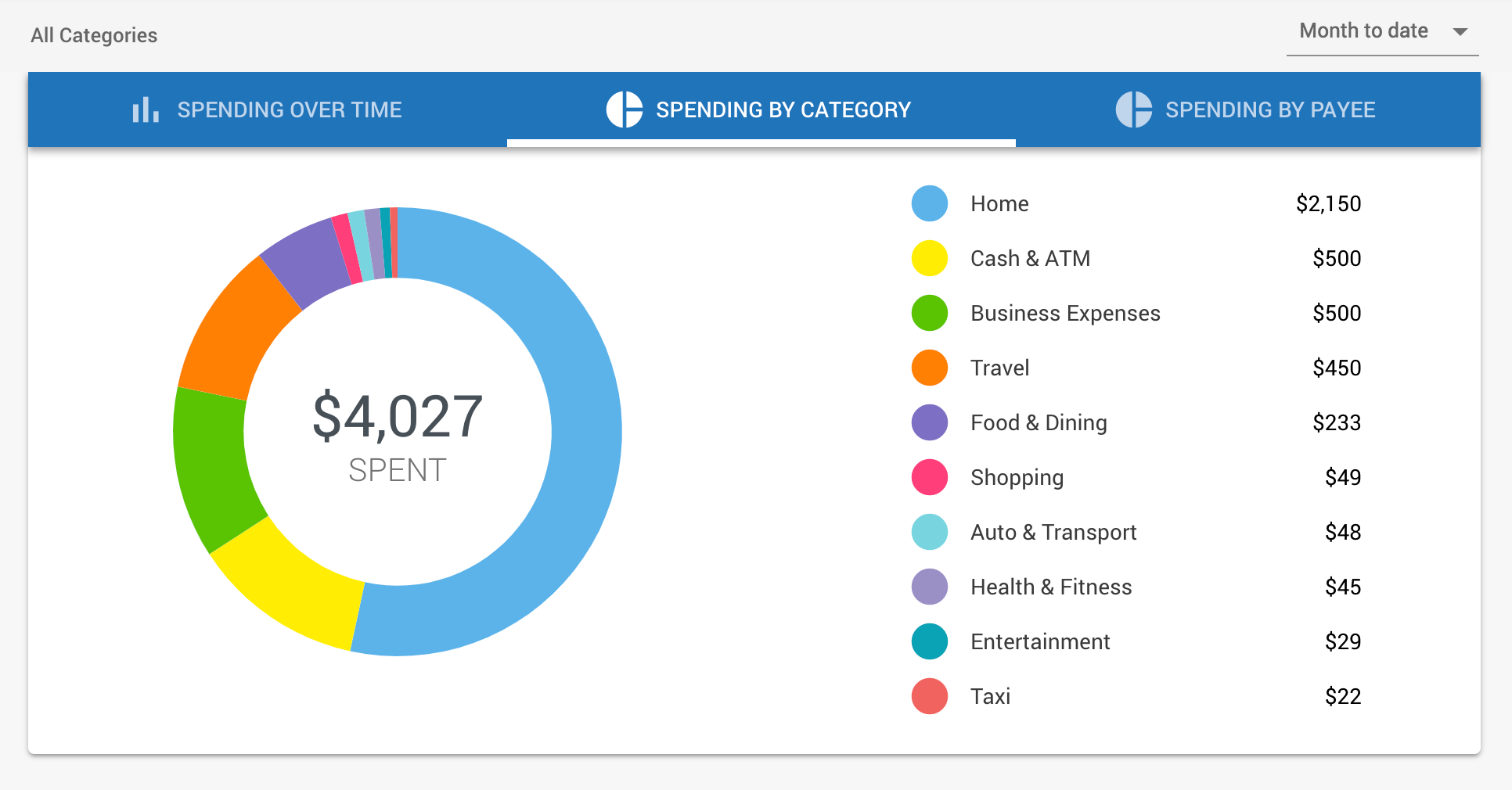

You can also set spending limits in various categories (such as shopping and entertainment), view how much you’ve spent in each area throughout the month, and receive alerts if you go over budget. You can see estimates of your home’s value from Zillow and your car’s value from Kelley Blue Book. Mint can link to your checking, savings, credit card, loan and investment accounts to let you see how your finances stack up, including a snapshot of your net worth. Introduced a decade ago, Mint continues to be a go-to application because it offers attractive, easy-to-use tools for tracking financial accounts and creating budgets. SEE ALSO: Kiplinger's Household Budget Worksheet.Best if: You want to budget the easy way.They are free except where otherwise noted.

#YOU NEED A BUDGET QUICKEN PASSWORD#

But all of them use security measures, such as encryption and password protection, to safeguard your information.

#YOU NEED A BUDGET QUICKEN PLUS#

A few let you enter transaction data manually-a plus if you’d rather not share your log-in credentials with a third party.

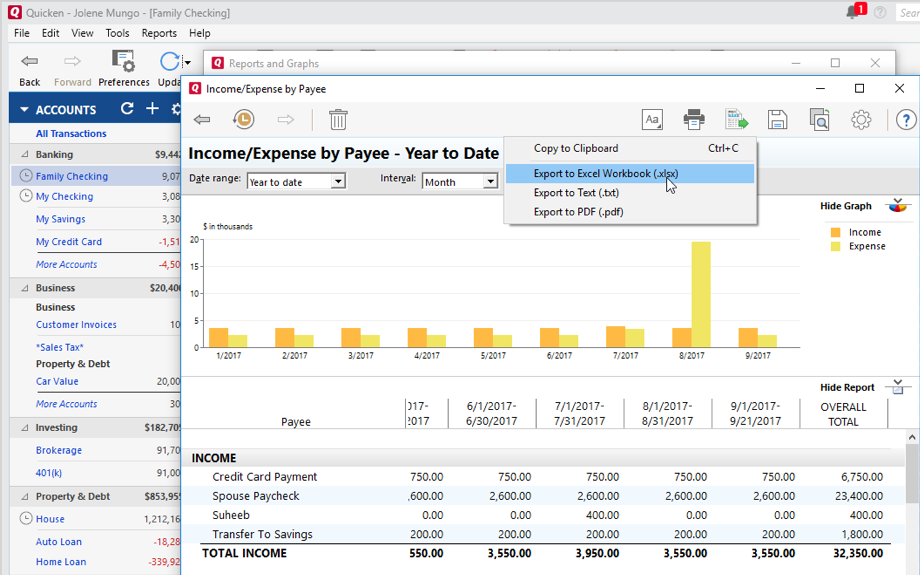

Some require you to share user names and passwords for your bank, credit card and other online accounts for quick, automatic updates of where your finances stand. We offer options that fit a variety of users. Others take a broader approach, providing simple expense and income tracking. Some sites cater to detail-oriented types who want to know “how much they spent on Coke versus Pepsi over the past six months,” says Steve Shaw, vice president of strategic marketing for the digital banking group at Fiserv (opens in new tab), a financial-technology company. No matter how you prefer to budget, you can probably find one to match your style and perhaps automate the task. Plus, budgeting doesn’t have to be painful if you take advantage of websites and mobile apps that help you get organized. It’ll also help keep you out of debt and give you a sense of control over your money. Developing a blueprint for how you intend to spend and save money is an important step to reach your goals, both in the short term and in the distant future. But it’s a good idea to put yourself through the budgeting paces periodically.

0 kommentar(er)

0 kommentar(er)